Payment Gateway vs. Payment Processor: Difference Explained

Digital payments have become one of the most used methods to send and receive money in the current era. Groceries, utility bills, and almost everything are being paid for online. This shift in the dynamics has made it necessary for businesses to understand how it works to provide value and ease to their customers. As you explore these billing options, you will hear two terms a lot: payment gateway vs payment processor.

Offering different ways to pay is very important if you want to grow your business and make more money. They use different digital billing methods to ensure a quick and easy checkout experience. Let’s unravel the dynamics.

What is a Payment Gateway?

To begin with, a payment gateway or billing engine is the easiest way for a business to accept payments online, through a website or app. It works like a bridge between the customer’s bank account and the platform where the billing happens.

The billing engine helps you accept payments using different methods, such as credit cards, debit cards, UPI, or online wallets. In simple terms, the billing engine makes sure that your transaction is safe and transfers the money to the merchant’s bank.

What is a Payment Processor?

Next, let’s discuss the payment processor or invoicer. This system handles the transaction between the buyer and the seller. When a customer buys something, the bill processor ensures that the money moves from the customer’s bank to the seller’s bank.

A money processor is like a helper who works behind the scenes. It communicates with banks and card companies to ensure the transaction is completed. Some popular payment processor examples are PayPal, Square, and Stripe. You might wonder, "Is Stripe a payment gateway?" Yes, Stripe is both a transaction and an invoicer, which is why many businesses use it.

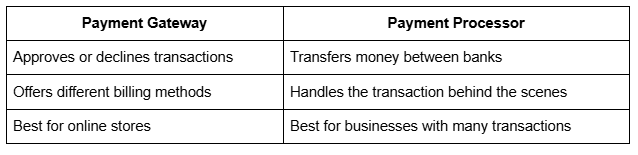

Payment Gateway vs Payment Processor: What’s the Difference?

Now, you might be thinking, “What’s the difference between a payment gateway and a processor?” Although they work together, they do different jobs.

A transaction facilitator collects and checks the customer’s transaction details, like credit card numbers. It keeps the information secure and prevents fraud. On the other hand, the invoicer moves the money from the customer’s bank to the merchant’s bank.

To sum up the differences:

When Should You Use a Payment Gateway?

A transaction gateway can be useful in many different situations. Here are a few examples:

- Online Stores: If you sell products online, a billing facility is a must. It lets you accept secure payments.

- Small Businesses: Small businesses, even if they don’t sell online, can use a billing engine to accept digital payments.

- Subscription Services: For businesses that offer subscriptions, a billing facility makes recurring payments simple.

- Charities and Nonprofits: Charities can use payment gateways to accept donations online, making it easier for people to give.

When Should You Use a Payment Processor?

An invoicer is great for handling transactions, especially if you’re dealing with many payments. Here’s when you’ll need one:

- High Transaction Volume: If your business has a lot of transactions, a billing processor will make sure everything runs smoothly.

- Credit Card Payments: If your business relies on credit card payments, you’ll need a processor to handle these transactions.

- Point of Sale (POS) Systems: If you accept payments in person, like in a store or restaurant, an invoicer makes sure all payments are processed quickly.

- International Payments: If you do business with international people, an invoicer helps you manage different currencies and billing methods.

How Does a Payment Gateway Work?

Let’s break down the steps of how a transaction facilitator works:

- Data Encryption: The billing engine takes your billing details and turns them into a secret code to keep them safe.

- Secure Connection: It then creates a secure link between your bank and the online store.

- Authorisation Request: The gateway asks your bank for approval to complete the transaction.

- Bank Approval: Your bank checks if you have enough money and sends an approval or decline message.

- Transaction Complete: If approved, the money goes through, and you’ll see a confirmation message.

How Does a Payment Processor Work?

Here’s how an invoicer works in simple steps:

- Transaction Starts: When you click to pay, the invoicer starts working.

- Details Sent to Bank: The merchant sends your billing details to the processor.

- Bank Approval: It contacts your bank to see if you have enough money.

- Funds Transferred: If approved, it moves the money to the merchant’s bank.

- Transaction Complete: Finally, the invoicer tells the merchant that the transaction was successful.

Key Takeaways

In conclusion, both money gateways and processors are necessary for handling online payments. Understanding the difference will allow you to integrate online payments into your business and provide your customers with the ease of not carrying cash or a card.

A billing engine ensures that the transaction process is secure, especially for online stores. On the other hand, a money processor moves money between banks, which is important if your business has a lot of transactions.

By knowing how credit card payment processing gateways and money processors work, you can make better choices about which system will help your business grow.

Recent Posts

- The Major POS Features and Benefits You Should Know

- Difference Between Cloud Pos Vs Traditional Pos

- Best POS System Benefits for Restaurants in Dubai

- Types Of POS Machine

- Restaurant POS System An Easy Way to Optimize Operations

- Where Does A Point of Sale Transaction Take Place

- Most Common Problems with a POS System

- CRM vs POS

- The Rising Importance of POS Inventory Management

- How POS Integration with E-Commerce is Helpful

- POS Inventory Management System - A Guide

- Android-pos-system

- How POS Security Systems Protect Businesses

- Optimizing Retail Operations with Automated Inventory Management

- Decoding the Advantages and Disadvantages of POS Systems in Retail

- Exploring Types of POS Systems for Retail Success

- Efficient Product Catalog Management Strategies for Retail Businesses

- Toast vs Clover: A Thorough Analysis

- The Necessity of POS System in Grocery Stores

- Shopify POS vs Square POS: Examining the Pros and Cons

- Is POS Integration Essential to Survive In Today’s World?

- Finding the Right POS System for Hair Salon

- The Ideal Café POS System

- Is POS Integration Essential to Survive In Today’s World?

- How to Use POS System - A Guide for Beginners

- Experience Excellence: Micros POS System Unleashed!

- Streamlining Payments: Exploring Automatic Data Processing in POS Systems

- Setting Up Your POS System: A Small Business Owner's Essential Guide

- Choosing the Perfect POS System for Your Grocery Store

- The Advantages Of A Food Truck POS System

- Optimizing Retail Inventory Management: Strategies & Tips

- Unlocking the Power of POS Reporting: Strategies & Insights

- What is a POS Machine and How it Works

- Exploring POS Software for Android Tablets: Enhance Your Business Efficiency

- Making Sense of POS Debit Charges: What to Know at Checkout

- Empowering Modern Retail: The Impact of Mobile POS System

- What Exactly is a POS Terminal? Definition and Meaning Explained

- Integrating POS Systems with FBR Invoicing: A Guide

- Upgrade Your Business: Easy POS Installation Tips & Best Practices

- Understanding POS Data Analysis: Implementation Guide

- Enhance Customer Loyalty: POS Loyalty Program Basics

- Hotel Point of Sale Systems: Features and Benefits

- Effective POS Campaign Strategies for Boosting Sales

- Gym POS Systems: Boost Management and Member Experience

- Boost Efficiency: Cloud-Based Customer Management Tips

- What is an electronic payment? How to use them

- Essential POS Security Tips to Protect Your Business

- Listing Management Software for POS: Simplify Sales

- Guide To The Best iPad POS Systems For Efficient Sales

- Customize Your POS System: Tailored Solutions for Business

- Pharmacy POS Systems: Manage Prescriptions & Inventory Easily

- Understanding Chargebacks: A Guide for POS Users

- POS vs EPOS: Key Differences and Benefits Explained

- What Are Contactless Payment Solutions?

- Top Retail KPIs to Track for Success with Your POS System

- How to Pass Credit Card Fees to Customers with POS Systems

- POS Wireless System: Simplify Payments with Advanced Tech

- How to Get PCI Compliance for Your POS System: A Complete Guide

- What Is NFC Mobile Payment and How Does It Work?

- Kitchen Display Systems (KDS): How They Enhance POS Efficiency

- What is PCI Compliance for POS Systems? A Complete Guide

- How to Increase and Compute Inventory Turnover Ratio

- How Does Barcode Work: Benefits and Uses

- Cash Register vs POS System: Key Differences Explained

- What is an Offline POS System?

- Multichannel Inventory Management: Sell More, Stress Less

- What is Shrink in Retail? Causes, Prevention, and Solutions

- How to Liquidate Inventory Quickly and Profitably

- QR Code Inventory Management Software: Features & Benefits

- Payment Gateway vs. Payment Processor: Difference Explained